This helps give traders an idea of how different assets may be performing over time, allowing them to make more informed decisions.

Entry Point – Crypto signals provide entry points for traders to capitalize on market conditions.By combining multiple sources into one unified service users get access to actionable insights that would otherwise take hours or days worth of research just to uncover on their own - allowing them more time focused on what really matters making money! Features Provided by Crypto Signals Additionally these companies may also provide automated algorithmic trading bots which trade based on certain pre-set parameters triggered by specific news stories or other conditions being met.Īll-in-all crypto signals can be incredibly valuable tools for investors looking for ways to maximize their profits while minimizing risk exposure when it comes to cryptocurrency investing. Consequently, many crypto signal providers monitor various news sources such as Bloomberg, CNBC and other outlets for anything that might affect the assets that users follow so they will know ahead of time how best to react if something happens unexpectedly.

News events also have a significant impact on the cryptocurrency markets as certain factors like sudden government regulations, new product launches from major exchanges and other news items can drastically affect prices overnight. By analyzing social media posts, news stories, investor messages and other data related to an asset or market, many crypto signal providers are able to generate sentiment-based crypto signals which allow traders to better predict future price movements. It’s often considered an indicator of future movements because it reflects the collective beliefs of those involved with that asset or market. Market sentiment is the overall attitude of investors towards an asset or market at any given time.

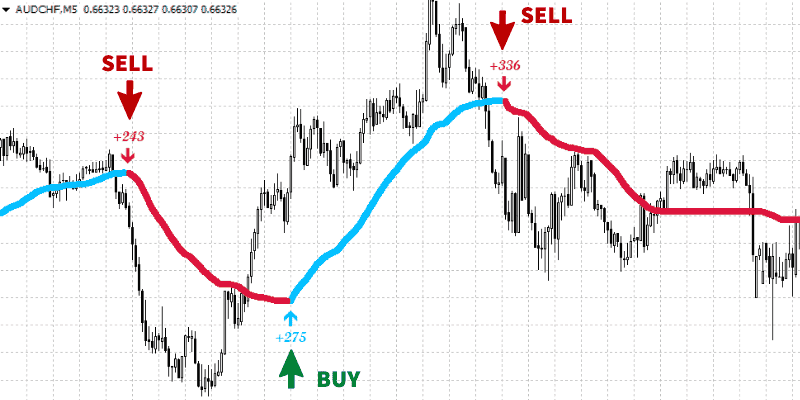

Many crypto signal providers offer technical analysis based services which alert users of upcoming changes in the markets they’re interested in. Technical analysis uses charts and graphs along with mathematical formulas and classic trading techniques like support/resistance levels, Fibonacci retracements and trendlines in order to identify buying or selling points for a particular market or asset. Technical analysis is a method used by investors and traders to evaluate past price movements in order to deduce potential future trends. They can also be generated from automated algorithms which analyze vast amounts of data in order to identify profitable trading opportunities.

Crypto signals can be derived from a variety of sources, including technical analysis, market sentiment and news events.

CRYPTO SIGNALS HOW TO

Crypto signals are essentially trading cues and indicators that are used by cryptocurrency traders to make decisions on when, where and how to invest their funds.

0 kommentar(er)

0 kommentar(er)